what is the tax rate in tulsa ok

The median property tax also known as real estate tax in Tulsa County is 134400 per year based on a median home value of 12620000 and a median effective property tax rate of 106 of property value. Tulsa County has a lower sales tax than 981 of.

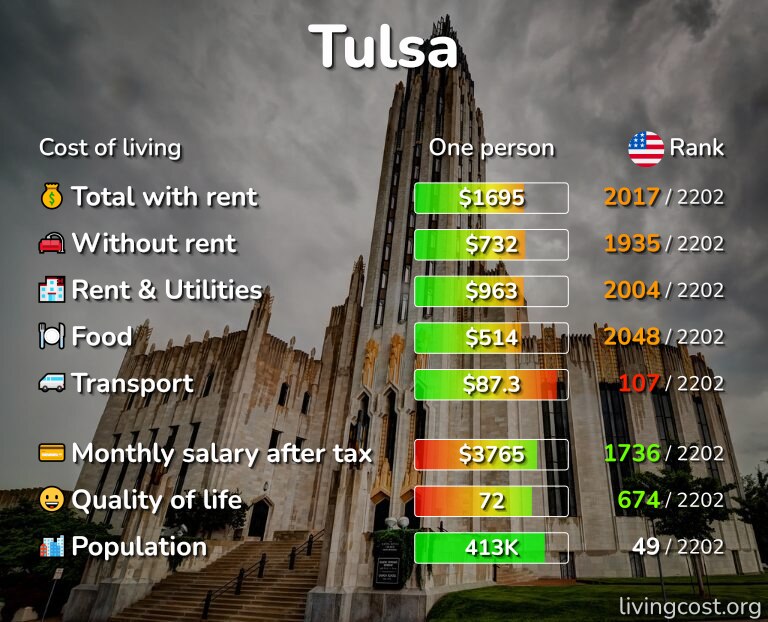

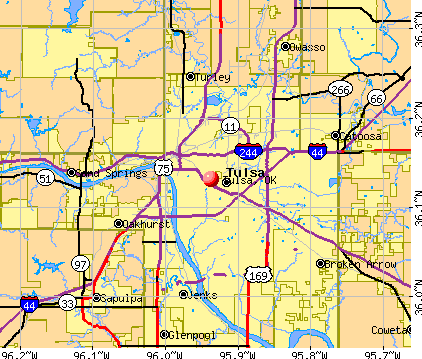

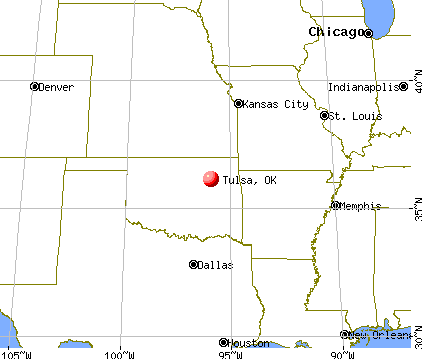

Tulsa Oklahoma Ok Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

The most populous location in Tulsa County Oklahoma is Tulsa.

. This rate includes any state county city and local sales taxes. Based on 10 income tax records 122000. The Tulsa Oklahoma sales tax is 852 consisting of 450 Oklahoma state sales tax and 402 Tulsa local sales taxesThe local sales tax consists of a 037 county sales tax and a 365 city sales tax.

2022 List of Oklahoma Local Sales Tax Rates. Oklahoma state income tax rate table for the 2022 - 2023 filing season has six income tax brackets with OK tax rates of 025 075 175 275 375 and 475 for. The December 2020 total local sales tax rate was also.

Tulsa collects a 4017 local sales tax the maximum local sales tax allowed under. The latest sales tax rates for cities in Oklahoma OK state. The most populous zip code in Tulsa County Oklahoma is.

2020 rates included for use while preparing your income tax deduction. Has impacted many state nexus laws and sales tax. Some rates might be different in Tulsa.

The Tulsa Oklahoma sales tax is 450 the same as the Oklahoma state sales tax. 2483 lower than the maximum sales tax in OK. The average total salary of Nurse Anesthetists in Tulsa OK is 172000year based on 10 tax returns from TurboTax customers who reported their occupation as nurse anesthetists in Tulsa OK.

The December 2020 total local sales tax rate was also. This rate includes any state county city and local sales taxes. This is the total of state and county sales tax rates.

The information on these pages has been carefully compiled to ensure maximum accuracy. The 2022 state personal income tax brackets are updated from the Oklahoma and Tax Foundation data. Tulsa County Sales Tax Rates for 2022.

You can print a 8517 sales tax table here. In addition to the county and districts like schools numerous special districts like water and sewer treatment plants as well as parks and recreation facilities are funded with tax capital. Average salary 172000 yr.

Oklahoma tax forms are sourced from the Oklahoma income tax forms page and are updated on a yearly basis. The current total local sales tax rate in Tulsa OK is 8517. By mail Make checks payable to the City of Tulsa and mail to the City of Tulsa Lodging Tax Processing Center 8839 North Cedar Avenue 212 Fresno CA 93720.

Oklahoma is ranked 972nd of the 3143 counties in the United States in order of the median amount of property taxes collected. The Tulsa Sales Tax is collected by the merchant on all qualifying sales made within Tulsa. 2021 Tulsa County Tax Rates.

The median property tax in Tulsa County Oklahoma is 1344 per year for a home worth the median value of 126200. Lowest sales tax 485 Highest sales tax 115 Oklahoma Sales Tax. The current total local sales tax rate in Tulsa County OK is 4867.

Rates include state county and city taxes. Property taxes are the cornerstone of local community budgets. 2020 rates included for use while preparing your income tax deduction.

As far as all cities towns and locations go the place with the highest sales tax rate is Glenpool and the place with the lowest sales tax rate is Leonard. The average cumulative sales tax rate between all of them is 828. In addition Tulsa County makes every effort to ensure the information is current.

A county-wide sales tax rate of 0367 is applicable to localities in Tulsa County in addition to the 45 Oklahoma sales tax. The Oklahoma state sales tax rate is currently. Before the official 2022 Oklahoma income tax rates are released provisional 2022 tax rates are based on Oklahomas 2021 income tax brackets.

County of Tulsa 2021 Levies Detail. 2020 rates included for use while preparing your income tax deduction. Oklahoma has state sales tax of 45 and allows local governments to collect a local option sales tax of up to 65.

Online You will need your new account number and PIN. The 2018 United States Supreme Court decision in South Dakota v. Heres how Tulsa Countys maximum sales tax rate of 10633 compares to other counties around the.

There is no applicable special tax. The latest sales tax rate for Tulsa OK. Lower sales tax than 69 of Oklahoma localities.

Oklahoma communities depend on the property tax to fund public services. Tulsa County collects on average 106 of a propertys assessed fair market value as property tax. Stillwater OK Sales Tax Rate.

The Tulsa County sales tax rate is. The Tulsa County Sales Tax is collected by the merchant on all qualifying sales made within Tulsa County. You can find more tax rates and allowances for Tulsa County and Oklahoma in the 2022 Oklahoma Tax Tables.

There are a total of 469 local tax jurisdictions across the. Some cities and local governments in Tulsa County collect additional local sales taxes which can be as high as 5766. The 8517 sales tax rate in Tulsa consists of 45 Oklahoma state sales tax 0367 Tulsa County sales tax and 365 Tulsa tax.

Oklahomas sales tax rates for commonly exempted categories are listed below. Select the File Pay Online button above. Nurse Anesthetist salary in Tulsa OK.

A county-wide sales tax rate of 0367 is applicable to localities in Tulsa County in. Tulsa County in Oklahoma has a tax rate of 487 for 2022 this includes the Oklahoma Sales Tax Rate of 45 and Local Sales Tax Rates in Tulsa County totaling 037. The minimum combined 2022 sales tax rate for Tulsa County Oklahoma is.

Tulsa County collects relatively high property taxes and is ranked in the top half of all counties in the United States by property tax. Tulsa County OK Sales Tax Rate. Tulsa OK Sales Tax Rate.

While Oklahoma law allows municipalities to collect a local option sales tax of up to 2 Tulsa does not currently collect a local sales tax. The Tulsa County Oklahoma sales tax is 487 consisting of 450 Oklahoma state sales tax and 037 Tulsa County local sales taxesThe local sales tax consists of a 037 county sales tax. The latest sales tax rate for Tulsa County OK.

Pros And Cons Of Living In Tulsa Ok Securcare Self Storage Blog

Tulsa Oklahoma Will Pay You 10 000 To Move There And Work From Home

Here There Tulsa Oklahoma Decatur Magazine

Tulsa Oklahoma Ok Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Tulsa Oklahoma Ok Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Tulsa County Oklahoma Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Tulsa Oklahoma Ok Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Tulsa Oklahoma Ok Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Timeline How The Tulsa Medical Office Mass Shooting Unfolded Abc News

Police Release Map Detailing Serious Crimes Around Tulsa

Pros And Cons Of Living In Tulsa Ok Securcare Self Storage Blog

The Best Places To Own A Home And Pay Less In Taxes The Good Place Estate Tax Tax

Tulsa County Oklahoma Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Tulsa Oklahoma Ok Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Tulsa Oklahoma City Among Forbes List Of Most Dangerous Cities